Growth Options document

SECTION 4 - THE STRATEGY

DELIVERING JOBS, HOMES AND INFRASTRUCTURE

4.1 Delivery is key to the success of the plan. The NPPF requires local plans to proactively drive and support sustainable economic development to deliver the homes, business and industrial units, infrastructure and thriving local places that the country needs.

4.2 To achieve the Vision and Objectives of the plan, the GNLP will help to drive economic growth, delivering an increase on forecast growth in jobs and productivity. The plan will aim to support the delivery of 45,000 additional jobs by 2036 and enable growth in the economy, including in high productivity sectors. To make this happen the GNLP will include policies that:

- Support the economy through infrastructure investment, environmental enhancement and quality of life improvements;

- Enable development of the strategic employment locations in the city centre, the Norwich Airport area, Broadland Business Park/Broadland Gate, NRP, Wymondham/Hethel, Longwater and the Food Enterprise Zone;

- Promote the Cambridge Norwich Tech Corridor growth initiative;

- Promote inclusive growth and social sustainability;

- Provide for local employment close to where people live;

- Support a thriving rural economy.

4.3 Growth will be located to make the best use of the existing transport and green infrastructure networks and community facilities, with new and improved infrastructure provided where it is needed to support growth.

4.4 The strategy will deliver the housing that is needed. To do this, we intend to provide sites for 42,865 new homes. Taking account of sites which are already permitted or allocated, we will need new sites for 7,200 homes. These figures include additional sites to provide a buffer to help ensure all the homes we need are delivered.

4.5 The plan will maximise urban brownfield site capacity and ensure greenfield development takes place in accessible locations, helping to sustain town and village life, providing choice and aiding housing delivery.

4.6 The majority of the planned growth is focussed in and around Norwich, with the city centre and other strategic employment sites supporting the area's regional, national and international economic functions and the suburbs and fringe parishes providing growing sustainable communities.

4.7 Growth of the economies of the main towns and rural areas will also be encouraged and supported, with some housing growth in all towns and in the villages with a range of services.

Question

'2. Do you support the broad strategic approach to delivering jobs, homes and infrastructure set out in paragraphs 4.1 to 4.7? (If you wish to comment on jobs and housing numbers, please see questions 3 to 6 below).

Jobs targets

4.8 Jobs targets help focus the aims of local plan policy and ensure that economic policy aligns with housing policy and demographic projections. Although a jobs target is not a requirement and not all local plans have one, not having a target would undermine the ability to deliver the vision and objectives of the GNLP.

4.9 The East of England Forecasting Model (EEFM) estimates jobs growth over the GNLP period and beyond. It is updated annually. The model's outputs are just one piece of evidence to assist in making strategic decisions. The model is robust but, as in all models, forecasts are subject to margins of error which increase at more detailed geographical levels. It is based on observed past trends which reflect past infrastructure and policy environments. Relatively recent infrastructure or policy changes have not fed through into these trends. It can be characterised as a "business as usual" forecast.

4.10 The Greater Norwich authorities are committed to working together to deliver more jobs overall than forecast, and a greater proportion of higher value jobs. This is reflected in the City Deal which commits to facilitate 13,000 more jobs than the target in the JCS. Taking account of subsequent EEFM forecasts, the SHMA[16] recalculates the impact of the City Deal and concludes that this equates to 45,390 jobs in the period 2015-2036.

4.11 The Employment, Town Centres and Retail study (GVA 2017) contends that "given the nature of the Greater Norwich economy it is unlikely 'business as usual' will be a true reflection of the future economy – as such an alternative growth scenario is required"[17]. This scenario looks in more detail at key economic sectors within Greater Norwich, local drivers, and the consequent prospects for growth. It concludes that there are good prospects to grow the local economy. The enhanced forecast would add an additional 44,000 jobs in the area between 2014 and 2036. This scale of jobs growth is a little lower than, but broadly consistent with, the City Deal and demonstrates that potential in high value sectors alone can deliver the majority of this enhanced growth.

4.12 The precise target for the GNLP will need to be calculated for the submission version so that the latest forecasts can be taken into account but currently the evidence suggests a target of around 45,000 jobs 2015-2036.

Options

|

Option JT1: Plan to deliver forecast jobs growth plus additional growth. This is consistent with the evidence and with our City Deal agreement with Government. This is the favoured option. |

|

Option JT2: Plan to deliver "business as usual" forecast growth only. This would be consistent with the GNLP's vision and objectives in broad terms, but would not help facilitate additional City Deal related jobs growth and could thus diminish the area's ability to fulfil its potential. This is considered to bea reasonable alternative. |

Question

'3. Which option do you support for jobs growth?'

Housing need

4.13 Additional housing is needed because:

- People are living longer with a tendency to smaller households. This increases the need for more houses irrespective of any growth in the population;

- More people are moving into the area, mainly from other parts of this country, both because of economic growth and for lifestyle choices;

- More people are in need of housing as not enough homes have been built in recent years leading to a significant housing shortage. This lack of housing delivery has led to the parts of the area having no "5 year land supply", which has resulted in planning permissions being granted for housing in locations not promoted in current local plans;

- The housing shortage in Greater Norwich has a significant impact on the quality of people's lives, particularly for younger people looking to set up home for the first time. It is important to note that Government policy aims to significantly boost the supply of houses for all in society.

4.14 Identifying the housing need for the plan requires the use of evidence and a clear methodology to be established. This part of the document seeks views on the proposed approach.

4.15 The NPPF[18] states that local plans should meet their objectively assessed need (OAN) for housing, with sufficient flexibility to adapt to rapid change. The way OAN is measured is changing. Until recently Local Planning Authorities (LPAs) commissioned Strategic Housing Market Assessments to establish OAN and more detailed housing evidence. In September 2017 the Government issued a consultation on a draft standard methodology for OAN[19]. This is a simplified methodology based on household projections uplifted by a factor that reflects affordability locally.

4.16 Evidence on the OAN for Greater Norwich had been established by the Central Norfolk Strategic Housing Market Assessment (SHMA) 2017 (see chapters 4 and 5 here for the SHMA and here for the Supplementary Note to the SHMA). As well as OAN, the report covers housing affordability and sets out the sizes, tenures and mix of housing required to meet needs. The SHMA identifies that the OAN for Greater Norwich from 2015 to 2036 is 39,486 homes (1,880 per annum).

4.17 The Government's proposed standardised methodology suggests the OAN for Greater Norwich is higher at 2,052 per annum. The methodology can be rebased to the current monitoring year to give an OAN from 2017 to 2036 of 38,988 dwellings. If a different approach is adopted by the Government the OAN figure could change during the plan making period. However, given the Government's clear intention, it is reasonable to base this local plan consultation on the draft methodology.

Calculating the housing numbers for the plan

4.18 The OAN is the starting point. Some local plans have a higher housing requirement than their OAN, for example because the area has to provide for unmet needs from surrounding districts, or a lower requirement because needs cannot be met within their boundaries for environmental or other reasons. The Norfolk Strategic Framework shows that there is no need for Greater Norwich to provide for unmet need from neighbouring districts. There is no evidence of any overriding reasons that prevent Greater Norwich meeting its own housing need.

4.19 The plan can provide for additional dwellings to support economic growth. The Government's draft standard methodology means the OAN already includes a significant uplift to address lack of affordability of around 400 dwellings per year (7,600 over 19 years). This uplift to support affordability also provides for homes to support other needs such as economic growth. The City Deal seeks to deliver an additional 13,000 jobs by 2031 on top of the 27,000 jobs planned for in the JCS. The SHMA calculates how many homes would be required in the GNLP to support this enhanced growth. A simple recalculation of the SHMA assessment to rebase to 2017 suggests that around 40,700 dwellings would be needed to support potential jobs growth (forecast growth plus City Deal aspirations). Therefore, the OAN of 38,988 dwellings provides for the majority of the additional housing growth required to support the City Deal, although around 1,700 further dwellings could be required. Neither the SHMA nor the standard methodology requires this additional growth to be included in the OAN. However, to support our City Deal and ensure economic potential can be met, the GNLP would need to allocate sufficient opportunities to allow for this additional housing growth to come forward.

4.20 Housing sites can take longer to come forward than expected. Consequently, it is essential to over-allocate to maximise the potential to deliver the housing that we need to tackle the housing shortage and to support economic growth. The extra allocation is known as a delivery buffer and is consistent with the NPPF requirement for flexibility[20].

4.21 A 10% delivery buffer on the 38,988 OAN established using the Government's methodology raises the plan provision to 42,887. Taking account of existing commitment in April 2017 of 35,665 homes, this means that the GNLP has a housing allocation requirement to provide land for 7,222 homes, rounded to 7,200.

4.22 A delivery buffer lower than 10% would make it much less likely that needs would be met. A higher figure might be expected to increase the likelihood that housing need would be delivered, but it would also increase uncertainty for both housing developers and infrastructure providers, potentially risking delivery.

4.23 Based on recent trends and projected future delivery, it is estimated that an additional supply of up to 5,600 dwellings could be provided during the plan period on "windfall" sites. These are sites which are not allocated through the plan. Windfall development often takes place on small scale non allocated sites or as higher than expected numbers on commitments. It can also include some larger scale sites and office-to-residential conversions allowed under permitted development rights. The actual sites that will come forward and the precise scale of delivery is unpredictable but it is reasonable to assume that windfall will provide an extra source of housing supply which will assist in ensuring the area's housing needs are met. Therefore the 10% delivery buffer provided by allocations could rise to as much as 24% if projected levels of windfall development are delivered.

4.24 Windfall development is a good source of small sites that can support small builders and aid overall delivery to ensure housing needs are met. The GNLP could include policies to encourage rural windfall (see question 43) and this would make it even more likely that the allowance is met or exceeded.

4.25 The additional plan provision and windfall development provides the flexibility to enable enough additional growth to come forward to fully support the jobs growth sought through the City Deal.

Question

4. Do you agree that the OAN for 2017-2036 is around 39,000

homes?

5. Do you agree that the plan should provide for a 10%

delivery buffer and allocate additional sites for around

7,200 homes?

6. Do you agree that windfall development should be in

addition to the 7,200 homes?

Delivering Infrastructure

4.26 Housing and jobs growth needs to be supported by the appropriate infrastructure, such as GP surgeries, hospitals, transport and schools, when it is required to meet the needs of new and growing communities. Fears that new infrastructure will not be provided are often voiced as reasons for opposing growth.

4.27 Ensuring new infrastructure needs are met requires a co-ordinated approach between a range of organisations, authorities and providers. Demonstrating such co-operation is necessary to ensure a sound plan.

4.28 Current policy on implementation[21] focuses on:

- Securing the provision of infrastructure and investment to support growth;

- Maximising the contribution of existing funding sources and investigating the scope for new ones;

- Co-ordinating the investment programmes of other public authorities and understanding the capital investment programmes of utility providers;

- Ensuring co-ordinated and timely implementation of infrastructure in line with development and regular review of the delivery programme;

- Delivering affordable/supported housing; and

- Identifying essential infrastructure including: transport, social infrastructure, local/renewable energy generation, water conservation, Sustainable Drainage (SuDS), strategic sewers, open space and green infrastructure, utilities, street furniture and public art.

4.29 This approach is supported by a delivery plan that identifies the key infrastructure requirements and a time period for delivery to support growth to 2026.

4.30 Current planned growth is dependent on the completion of strategic infrastructure improvements including the NDR and improvements to the A47 at Thickthorn (the A11/A47 junction), along with the completion of dualling between Dereham and Acle. Work is progressing on these schemes, with the NDR to be completed in early 2018 and the A47 improvements planned to start in 2020. These improvements may provide growth opportunities.

4.31 The Greater Norwich authorities all charge the mandatory Community Infrastructure Levy (CIL) on relevant developments. As part of the City Deal, the Greater Norwich authorities committed to pooling CIL income to create a substantial local growth fund for delivering infrastructure. The City Deal partners also have the ability to borrow up to £60 million against future CIL income to help forward-fund infrastructure.

4.32 Following consideration of the national CIL Review Panel's report, the Government's Housing White Paper (HWP) Fixing our Broken Housing Market, published in February 2017, stated that there will be an announcement about the future of the developer contributions system (CIL and Section 106) in the Autumn Budget 2017. Given the uncertainty, the Greater Norwich authorities have not yet undertaken a review and update of CIL since originally adopting it. However, a review of CIL is a possibility dependent on Government announcements.

4.33 The revenue generated from development via planning obligations and CIL is sensitive to economic fluctuations; when economic downturns happen, they impact the development industry and the rate of delivery can fall steeply and take time to recover (as happened between 2008-2012). As most off-site infrastructure is at least part-funded through CIL, a slowing economy will lead to reduced CIL income and thus reduced ability to deliver infrastructure – although if development rates slow, then the need for new infrastructure may also be somewhat delayed.

4.34 In recent years greatly increased emphasis in national policy on development viability has led to a number of measures by central government to enable viability to be reviewed and s106 planning obligations renegotiated where necessary to ensure that a viable development can proceed.

4.35 The GNLP will look forward at infrastructure required to support the planned growth to 2036. There has been consultation with the major infrastructure bodies and, up to now, none have identified the need for further strategic improvements to support the overall scale of growth identified. The infrastructure requirements will vary depending on the distribution of growth and this evidence will need to be established once the range of growth options has been narrowed down. In turn the infrastructure requirements will provide valuable evidence to fine tune the exact distribution of the new growth.

4.36 It can be expected that over the timescale of the GNLP there will be further significant and wide-ranging changes to national planning policy. In addition, there will inevitably be changes in priorities and needs arising from technological changes. The key to a successful strategy for the GNLP relies on developing an implementation plan which is flexible and responsive enough to adapt to change.

4.37 The Greater Norwich authorities will continue to explore the feasibility of developing a Local Delivery Vehicle (LDV), which could have the potential to invest money in sites, forward-fund the installation of infrastructure to de-risk sites, and recoup the initial investment through the uplift in the value of the land, to then be deployed to another site or sites.

4.38 The Housing White Paper[22] states that the Government is interested in agreeing "bespoke housing deals" with authorities which have "a general ambition to build". This could involve the use of "planning freedom" powers introduced through the Housing and Planning Act 2016, the alignment of infrastructure spending, support from the Homes and Communities Agency (HCA) and various other measures. This too will be explored as a tool to assist with the delivery of planned housing.

4.39 Issues workshops took place in summer 2016, involving key stakeholders from the public, private and voluntary sectors, and parish council representatives – see Appendix 8 of the November 2016 Greater Norwich Development Partnership meeting for the full summary notes. There were a number of comments suggesting that the Greater Norwich authorities should take a more interventionist approach to help better ensure delivery of important housing sites – for example, through up-front delivery of key infrastructure.

Question

,'7. Are there any infrastructure requirements needed to support the overall scale of growth?

HOW SHOULD GREATER NORWICH GROW?

Existing Housing Commitment

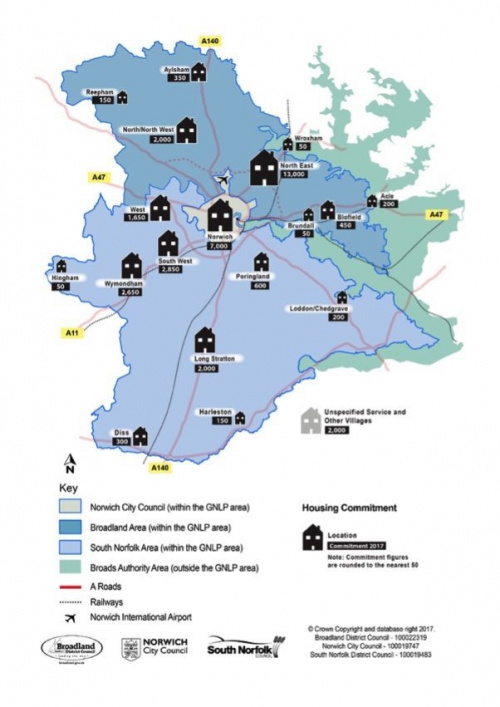

4.40 The locations for the majority of the GNLP housing growth have already been established through existing housing commitments[23]. Broad locations for the housing commitment as of April 2017 are set out in figure 2 below. More detail on the housing commitment figures is in appendix 1. Our approach assumes that existing housing commitments can be delivered.

Question

8. Is there any evidence that the existing housing commitment will not be delivered by 2036?

Figure 2 Housing Commitment

Housing Growth options

4.41 In line with the NPPF, a settlement hierarchy will help shape growth options for identifying sites for the additional 7,200 homes we believe we require.

4.42 The hierarchy is a reflection of the range and type of services available in and accessible from communities and is a guide to sustainability. While the hierarchy is a starting point it does not, by itself, determine the scale of development that is appropriate in any particular settlement. This will take account of factors such as the scale, range and quality of local services; deliverability; location in relation to strategic services and job opportunities and local constraints and opportunities.

4.43 The current levels in the hierarchy set out in the JCS, are "Norwich Urban Area", "Main Towns", "Key Service Centres" (KSCs), "Service Villages", "Other Villages" and "Smaller Rural Communities and the Countryside".

4.44 The Norwich Urban Area is defined as the city council area plus the adjoining suburban and fringe parishes.

4.45 The Main Towns of Wymondham, Diss (including Roydon), Harleston and Aylsham have a good range of day to day services and local employment. Long Stratton is currently a KSC, but with the planned growth will become a Main town.

4.46 KSCs are larger villages with some services and employment. These are Acle, Blofield, Brundall, Hethersett, Hingham, Loddon/Chedgrave, Poringland/Framingham Earl, Reepham and Wroxham.

4.47 The current definition of Service Villages and Other Villages reflects their range of basic services. The authorities wish to consider whether a new "group" based approach would be better for village growth. Accordingly, proposals for potential revisions to the settlement hierarchy in the GNLP are set out in paragraphs 4.152 to 4.160 below.

4.48 This section deals with how much overall growth should be focussed in all of the settlements at different levels of the hierarchy rather than where individual settlements should be placed in the hierarchy.

Baseline Assumptions

4.49 To meet national policy requirements to make the most efficient use of land, it is critical that the best possible use is made of brownfield land, which is mainly within Norwich and the urban fringe.

4.50 As well as supporting regeneration, such sites generally have better access to services, facilities, public transport, walking, cycling and employment opportunities. The failure to redevelop such sites would result in the need to identify additional greenfield sites elsewhere.

4.51 However, large numbers of brownfield sites are already committed through existing plans and the potential to identify additional sites is limited.

4.52 There is also a need to balance the amount of land required for housing with other uses, such as employment, other town centre uses and open space.

4.53 There are 7,000 homes already commited in Norwich. It is currently estimated that there is capacity on brownfield land for 1,500 additional homes in Norwich, along with 200 in the Broadland part of the urban fringe. Work is onging to see if any more brownfield sites can be identified for development.

4.54 The GNLP also needs to maintain and enhance the vitality of towns and villages by planning for new development appropriate to the local range of services and facilities. This growth will help meet the overall level of housing need across the area by ensuring diversity and competition in the market for land, and by allowing opportunities for small scale builders. It will also promote social sustainability, in some cases helping people to continue to live where they have grown up, and to provide choice. This is particularly relevant given that many of the existing housing commitments are in large sites around Norwich.

4.55 Taking account of the above, to achieve the requirement for 7,200 homes, the approach taken to identifying broad growth locations is:

Firstly, establish a baseline of 3,900 homes that:

- maximises delivery on previously developed land within Norwich and the built up areas of the fringe parishes (1,700 homes);

- maintains and enhances the vitality of smaller settlements by ensuring a minimum level of growth in Main Towns and Key Service Centres (1,000 homes), Service Villages (1,000 homes) and Other Villages (200 homes) or Village Groups, some of which may be on previously developed land;

Secondly, identify alternative growth options for the remaining 3,300 homes in fringe locations, Main Towns, KSCs and Other Villages (or Village Groups) - see figure 3 on page 28 and appendix 1.

Options for the distribution of the remaining growth

4.56 Six growth options are set out in this document to help to determine the most appropriate distribution of sites to be allocated for the additional 3,300 homes not in the baseline.

4.57 The growth options provide alternatives with varying degrees of concentration nearer Norwich, focus on transport corridors and dispersal around the area, including the potential for a new settlement.

4.58 New settlements built to Garden City principles[24] may offer an additional means of providing for growth and can, in the long term, create attractive new communities with a good range of services in accessible locations. This is because, if fully supported by the landowner, developer and local authorities, much of the uplift in land value resulting from the granting of planning permission can be invested in the new community itself.

4.59 As new settlements require significant investment in infrastructure, they can be challenging to deliver if effective mechanisms for securing the uplift in land values and to assist in providing infrastructure are not put in place. Therefore it is expected that a legal agreement would be required to ensure sufficient investment is available for any new settlements to be taken forward through the plan making process. If this is not achieved then there is the very real risk that CIL or other funding that would support potentially better value for money growth elsewhere could be diverted to a new settlement.

4.60 It is essential that locations for new settlements allow easy access to existing services in the short term until a critical mass of housing is achieved to allow a free standing new community with its own services to be established in the long term.

4.61 The absolute minimum eventual size for a new settlement is likely to be around 2,000 homes as this could support a primary school and a small range of local shops and other services. The larger a settlement grows to, the wider range of services it can support.

4.62 The time taken to bring new settlements forward means they could not provide significant amounts of housing before 2036, but would rather provide for an element of a long term strategic approach to growth in Greater Norwich.

4.63 Two sites submitted through the Call for Sites potentially provide the amount of land that could support a new settlement. These are at Honingham Thorpe (including land in Barford, Easton, Marlingford and Colton) and to the west of Hethel. The Honingham Thorpe site (site reference GNLP 0415 A to G in the Site Proposals document) is 360 hectares and is proposed for housing, employment and a country park. The other site (site reference GNLP1055 West of Hethel, Stanfield Hall Estate, Stanfield Road) is 364 hectares and is proposed to be a garden village with housing, hi-tech employment uses and community facilities. Site maps are available in the Site Proposals consultation document. Other potential sites may be identified, possibly through this consultation. Comments on new settlements can be made in response to question 12 below and through the Site Proposals consultation document.

4.64 A topic paper provides further detail on issues associated with the development of new settlements.

The Growth Options

4.65 It is important to note in relation to the six growth options that:

- Options are being tested through this consultation. Taking account of existing commitments in any individual settlement, there may be constraints e.g. in relation to infrastructure capacity and delivery, or environmental issues.

- Options refer to the total scale of additional growth in a location. To maximise delivery, where significant growth is proposed it may be spread over multiple sites. Larger sites may be allocated where early delivery can be demonstrated – for example where a site is an extension to one already being developed.

- Economic, housing need and housing delivery evidence, plus the high level of existing commitment in Broadland, suggests overall levels of growth should be higher in South Norfolk than Broadland.

- The strategy chosen for the submission plan in 2019 may be an amalgam of the options. The options aim to provide a framework for considering different strategic approaches.

4.66 The following table illustrates the scale of new growth and the new level of commitment that would result from each of the six options (in brackets). Figure 3 sets out: the existing commitment; the proposed additional growth; and total growth figure to 2036. More detail on the options, including conceptual maps, is in appendix 1.

Figure 3 Strategic Growth Options

|

|

|

|

|

Growth Options |

|||||

|

Location |

Parish / Area |

Homes Committed |

Option 1 Concentration Close to Norwich |

Option 2 Transport Corridors |

Option 3 Supporting the Cambridge to Norwich Tech Corridor |

Option 4 Dispersal |

Option 5 Dispersal plus New Settlement |

Option 6 Dispersal plus Urban Growth |

|

|

Norwich |

6,999 |

1,500 (8,499) |

1,500 (8,499) |

1,500 (8,499) |

1,500 (8,499) |

1,500 (8,499) |

1,500 (8,499) |

||

|

North East |

Growth Triangle |

12,516 |

1,200 (14,176) |

1,200 (14,176) |

200 (13,176) |

200 (13,176) |

200 (13,176) |

1,200 (14,176) |

|

|

Thorpe St. Andrew |

365 |

||||||||

|

Elsewhere |

95 |

||||||||

|

North / North West |

Hellesdon |

1,377 |

600 (2,619) |

200 (2,219) |

0 (2,019) |

100 (2,119) |

100 (2,119) |

200 (2,219) |

|

|

Horsford |

284 |

||||||||

|

Drayton |

285 |

||||||||

|

Elsewhere |

73 |

||||||||

|

West |

Bawburgh |

14 |

500 (2,125) |

500 (2,125) |

500 (2,125) |

100 (1,725) |

100 (1,725) |

500 (2,125) |

|

|

Costessey |

706 |

||||||||

|

Easton |

905 |

||||||||

|

South West |

Cringleford |

1,458 |

1,200 (4,028) |

500 (3,328) |

1,500 (4,328) |

150 (2,978) |

150 (2,978) |

200 (3,028) |

|

|

Hethersett |

1,295 |

||||||||

|

Little Melton |

68 |

||||||||

|

Elsewhere |

7 |

||||||||

|

Other Fringe Sectors |

1,933 |

0 |

0 |

0 |

0 |

0 |

0 |

||

|

(1,933) |

(1,933) |

(1,933) |

(1,933) |

(1,933) |

(1,933) |

||||

|

Main Towns |

5,468 |

550 |

1,650 |

1,250 |

1,200 |

1,200 |

700 |

||

|

(6,018) |

(7,118) |

(6,718) |

(6,668) |

(6,668) |

(6,168) |

||||

|

Key Service Centres |

674 |

450 |

450 |

550 |

850 |

850 |

600 |

||

|

(1,124) |

(1,124) |

(1,224) |

(1,524) |

(1,524) |

(1,274) |

||||

|

New Village(s) |

0 |

0 |

0 |

500 |

0 |

500 |

0 |

||

|

(0) |

(0) |

(500) |

(0) |

(500) |

(0) |

||||

|

Service and Other Villages or Village Groups (including Countryside under option SH2) |

1,060 |

1,200 |

1,200 |

1,200 |

3,100 |

2,600 |

2,300 |

||

|

(2,260) |

(2,260) |

(2,260) |

(4,160) |

(3,660) |

(3,360) |

||||

|

Countryside |

83 |

0 |

0 |

0 |

0 |

0 |

0 |

||

|

(83) |

(83) |

(83) |

(83) |

(83) |

(83) |

||||

|

Total New Allocations |

7,200 |

7,200 |

7,200 |

7,200 |

7,200 |

7,200 |

|||

|

Total Housing Provision (2017 to 2036) |

(42,865) |

(42,865) |

(42,865) |

(42,865) |

(42,865) |

(42,865) |

|||

|

|

|

|

|

|

|

|

|

|

|

Options

|

All of the six options are reasonable alternatives. Analysis Maximising the benefits of growth and minimising any resulting conflicts presents a number of choices which must be carefully balanced when identifying the most appropriate growth strategy for Greater Norwich. While the options provide for only around 8% of the total housing allocations in the plan[25] which will carry forward existing commitments, the approach will have important long term implications for our urban and rural communities. Access to services and jobs are key considerations, as is the need to ensure that housing is allocated in the locations most likely to deliver to meet housing need. Social, environmental and economic implications must all be considered in deciding the best growth strategy. All the growth options aim to maximise growth on brownfield sites. However, it is important to note that large numbers of brownfield sites are already committed through existing plans in the area and the potential to identify additional sites is limited. The need to balance the amount of land required for housing and employment uses is a particular consideration in the city. All the options also aim to enhance the vitality of towns and villages by providing them with "baseline" levels of growth. Different options provide different amounts of additional growth in towns and villages which could further assist in supporting vitality, though consideration must be given as to whether supporting services and facilities will be accessible in smaller settlements. The size of allocations will also be a key consideration. Whilst larger sites can provide new services and facilities, recent experience has shown that they are more difficult to get off the ground. Smaller sites are often more likely to deliver and can support the vitality of existing settlements. Sites of less than 10 dwellings often do not provide affordable housing or the mix of housing sizes to provide the type of housing choice needed, particularly in our smaller communities. On the other hand, small sites offer the opportunity for self-build and for smaller builders which can increase the speed of housing delivery. Capacity in the industry will have to be significantly increased if very large numbers of small sites are allocated. Options 4 and 5 are more likely to address the draft plan objective to deliver homes. This is because they provide for a much wider dispersal of development, and in doing so increase diversity, choice and competition in the market for land, which should be beneficial for delivery. They would also increase social sustainability by providing opportunities for people to continue to live in villages. Options 1,2 and 3 focus growth in locations that have significant outstanding commitment and have experienced delivery issues over the JCS period. Option 6 is somewhere in between. However, Options 1, 2 and 3 perform better than alternatives 4 and 5 in relation to plan objectives that seek to improve air quality, reduce the impact of traffic, address climate change issues, increase active travel and support economic development. This a result of the better geographical relationship of development under these options to services, facilities, employment opportunities and sustainable transport options. Again Option 6 is somewhere in between. |

Questions

- Which alternative or alternatives do you favour?

- Do you know of any infrastructure constraints associated with any of the growth options?

- Are there any other strategic growth options that should be considered?

- Do you support the long term development of a new settlement or settlements?

Green Belt

4.67 CPRE Norfolk have launched a campaign for a Green Belt for Norwich.

4.68 Green Belts cannot be established as a means of restricting growth, but rather form part of a strategy for accommodating growth. They are established for the long term so a Green Belt would direct patterns of growth in Greater Norwich well beyond the end of this plan period.

4.69 The NPPF explains that Green Belts serve five purposes: checking the unrestricted sprawl of large built-up areas; preventing neighbouring towns merging; assisting in safeguarding the countryside; preserving the setting and special character of historic towns; and assisting urban regeneration. All of these purposes could be of relevance to Greater Norwich.

4.70 Critically, the NPPF says that new Green Belts should only be established in exceptional circumstances, for example when planning for new settlements or major urban extensions. The NPPF[26] also says "the general extent of Green Belts across the country is already established", emphasising the exceptional circumstances required for a new Green Belt. If proposing a new Green Belt, the NPPF states local planning authorities should:

- demonstrate why normal planning and development management policies would not be adequate;

- set out whether any major changes in circumstances have made the adoption of this exceptional measure necessary;

- show what the consequences of the proposal would be for sustainable development;

- demonstrate the necessity for the Green Belt and its consistency with local plans for adjoining areas; and

- show how the Green Belt would meet the other objectives of the NPPF.

4.71 Because they are long term, it would be necessary to demonstrate that future growth beyond 2036 could be accommodated if a Green Belt were established. So, for example, land around the urban fringe or other settlements might be excluded from a Green Belt to provide future options for development.

4.72 As illustrated in figure 4 below, Green Belts can take the form of continual belts around a city and its surrounding settlements of different scales or of green wedges.

Figure 4 Green Belt approaches

4.73 We do not believe there is evidence to meet the exceptional circumstances required by the NPPF to justify the establishment of a Green Belt for Norwich. This is because:

- A wide Green Belt surrounding the Norwich urban area and inner settlements would have a significant impact on the delivery of sustainable development by restricting growth in those towns and villages that are closest to Norwich and are best placed to make the fullest possible use of public transport, walking and cycling. It would instead create a long term approach lasting beyond the plan period which focuses growth on areas further away from the city, generates longer journeys and could create affordability issues by restricting the supply of housing closer to the main areas of demand;

- A narrow Green Belt between Norwich and the first ring of larger settlements would prevent development between Norwich and its nearest towns and villages, but would increase pressure on those villages and towns in the longer term. This could have a significant impact on the form, character and appearance of those towns and villages, and the countryside that surrounds them;

- Green Belt wedges would most likely be based on the current plan approach of landscape protection zones around the Southern Bypass, and potentially the NDR, existing Strategic Gaps, the protection of river valleys and the preservation of undeveloped approaches to Norwich. This approach would reduce the impact on providing for sustainable locations for development. Since current local plan policies are directly aimed at, and have been broadly successful in, protecting these areas it would be very difficult to meet the Government's requirements set out in paragraph 4.70 above.

4.74 However, we will need to ensure that the strong protection policies for our landscape and environmental assets in current plans are carried forward and strengthened where necessary. This includes landscape protection zones around the Southern Bypass (and potentially the NDR), retaining existing Strategic Gaps, the protection of river valleys and the preservation of undeveloped approaches to Norwich as set out in option LA1 on page 104 of this document.

Question

- Do you support the establishment of a Green Belt? If you do, what are the relevant "exceptional circumstances", which areas should be included and which areas should be identified for growth up to and beyond 2036?

Norwich City Centre

Context

4.75 The NPPF promotes a town centres first approach, placing a strong focus on ensuring the vitality of centres.

4.76 Norwich's vibrant, attractive, historic city centre plays a pivotal role in the economic success of Greater Norwich. The city's significance as an economic driver and attractor of investment of skilled labour is extremely important to Greater Norwich's economy. The plan needs to strengthen these roles and support regeneration of the city centre as the strategic hub for shopping, leisure, culture and tourism, as an employment and education location and as an attractive place to live. A high quality city centre will continue to attract innovative knowledge based industries to the centre itself and to Greater Norwich as a whole.

4.77 In addition to identifying development sites, a range of other policies will be needed to help to attract investment. These will broadly continue the approach taken in the JCS. The approach will cover improvements to sustainable access, green infrastructure and the public realm, promotion of high quality development to protect and enhance the city's historic assets, support for the city's distinctive cultural, retail and leisure offer, improvement of air quality and promotion of the regeneration of brownfield sites to provide more jobs, homes and services.

4.78 Discussions at the issues workshops focussed on issues related to parking and recent changes to access to the city centre, which were largely welcomed. There was some support for restrictive retail policies, but some suggested policies should be more flexible, allowing restaurants and shops to locate within the city centre without restriction. The importance of the redevelopment of Anglia Square, possibly including some convenience offer, was also emphasised.

Defining the city centre area

4.79 The JCS currently defines a broad city centre with different areas for retail, leisure and office uses. The broad area lies inside the city walls, along with the area around Sainsbury's south of Queens Road, Riverside, the railway station and the area around Norwich City's football ground. This area is shown on the map in appendix 2. The most likely areas which could be included in the city centre are;

- Land to the west of the Inner Ring Road between Dereham Road and the Barn Road roundabout;

- Land near the River Wensum to the east of Norwich City Football Club (Laurence Scott Electromotors, the Utilities Site and the Deal Ground).

Options

|

Option CC1 Retain the current definition for planning purposes of the city centre Retaining the current city centre boundaries would encourage intensification of city centre uses within the currently defined area, enabling the centre to remain relatively compact, vital and vibrant and to continue to be well served by public transport. A positive approach to identifying sites for city centre uses within the currently defined centre would enable appropriate sites for jobs, homes and services to be identified. In addition, the recent trend to make more intensive use of existing buildings, most particularly shops and offices, could be further encouraged. Effective design policies could continue to ensure that intensification does not affect the historic character of the city centre. This could be done through continued use of the City Centre Conservation Area Appraisal, with updating it if necessary. This is the favoured option. |

|

Option CC2 Enlarge the area defined as the city centre The limited amount of space and sites within the currently defined city centre may not be able to provide for the increased need for city centre functions identified in the evidence base without intensifying the use of land, which risks having a negative impact on the historic character of the city. If locations cannot be identified for city centre uses such as retailing in the currently defined centre, there is a risk that more out of town development could take place which could undermine city centre vitality and viability in the long term. However, extending town centre uses could also encourage less intensive, car based, land hungry development which would be more difficult to serve effectively by public transport. This is a reasonable alternative. |

Question

- Should the area defined as the city centre be extended?

Strategic city centre policy

4.80 Given the town centres first focus of national policy, the importance of the city centre to the economy of Greater Norwich as a whole and the enhanced potential for accessing external sources of funding when strategic planning policies for centres are in place, there is a clear need to have a strategic policy to guide development in city centre. The city centre policy should identify the amount of land needed for retail, leisure, and commercial development and allocate sites where possible. The policy should also include a vision for the city centre, with strategic priorities, to highlight aspirations and opportunities for the city centre to help increase Greater Norwich's profile at the national and international level. This vision would cover key objectives including:

- increasing employment, particularly in high value growing sectors;

- increasing the residential population;

- enhancing the retail offer;

- maximising the tourism and leisure opportunities;

- creating a regional learning and innovation centre;

- enhancing connectivity, providing vehicular access to jobs, homes and shops, a public transport hub for the area and a green, walkable, cycle friendly centre.

The vision would be in parallel to, and informed by, collaborative work with other key city centre partners, including the Business Improvement District (BID). By combining a strong vision with site allocations and working with key partners, the GNLP can assist in providing a common marketing narrative for the city centre which could help to secure investment, and provide a focus for public/private partnerships, enabling better use to be made of land and providing support for economic growth sectors. The vision could also provide the hook for supplementary planning documents to be developed for specific issues, such as providing a public realm and green infrastructure strategy which could identify specific locations for improvements.

Question

- Do you support the approach to strategic planning for the city centre in 4.80 above?

Specific city centre issues and questions

4.81 There are a number of specific city centre issues identified through evidence studies and experience of implementing the JCS which need to be addressed. These specific issues are followed by focussed questions below.

City centre offices

4.82 Office provision in the city centre has fallen by 8% since the start of the JCS planning period in 2008. The reduction is largely due to recessionary pressures and poorer quality office stock being converted to residential uses through changes in national planning policy making such conversions permitted development. There has also been limited market demand for speculative development of high quality offices, competition from new offices on the edge of the city and intensification of use in many remaining city centre offices.

4.83 The Retail, Employment and Town Centres Study, along with other evidence, identifies a more positive picture for the potential future of office based employment in the city centre. The enhanced growth forecast shows an estimated additional demand to 2036 for Greater Norwich as a whole of around 170,000 sqm of B1a (offices)/b (R+D) floorspace which rises to 340,000 sqm if windfall losses and churn are taken into account. While a significant amount of this demand will be accommodated at NRP and on out of centre business parks, a large proportion should be allocated in the city centre to help sectors based in the centre to grow, to realise sustainability benefits and achieve the economic benefits of agglomeration.

4.84 The evidence shows that the character of the city centre and its office stock is suited to the further development of knowledge intensive businesses. Such businesses typically form clusters in central locations which support face-to-face working and provide amenities. As a result, the main city centre growth sectors to 2036 are identified as digital, cultural and creative industries[27] and financial services (particularly "FinTech[28]" businesses).

4.85 Digital, cultural and creative industries are one of the fastest growing sectors in the UK, with Norwich having one of the most highly concentrated and diversified creative industry clusters, employing nearly 7,000 people in 2016. Many digital tech businesses are international in their outlook. Norwich University of the Arts (NUA), City College, the EPIC TV studios and incubation space for creative businesses have the capacity to stimulate development of the sector by providing creative expertise and skilled labour.

4.86 The strategic approach for the city centre therefore needs to play to its strengths by prioritising investment in these businesses to maximise job creation and support competitiveness.

4.87 Such an approach will also support the growth of other employment sectors which do not locate in city centres by providing a vibrant hub to attract business into Greater Norwich as a whole.

4.88 To enable the growth of a broad range of knowledge based and other businesses, both high quality grade A office space and more affordable and flexible "start-up" and "grow-on" facilities need to be provided in the city centre, potentially through public/private partnerships. These could either take the form of mixed use or stand-alone employment developments.

4.89 The current JCS identifies primary office development locations as Anglia Square, the St Stephens area, Barrack Street/Whitefriars, Barn Road, and the King Street/Rouen Road/Mountergate area. Other policies allocate sites for office uses and require some office provision in all developments.

Question

- What should the plan do to reduce office losses and promote new office development in the city centre?

Retailing

4.90 Norwich is very high in the national retail rankings, at 13th. The high ranking is based on a strong and attractive retail offer and the city's large hinterland with a growing population, with the main competing centres being some distance away.

4.91 Due to its large size, the JCS divides the city centre into inter-dependent retailing areas with different functions. As well as the central Primary retail area with its focus on providing locations for large scale retailers, the key diagram identifies a number of shopping areas around the city centre as "Other shopping areas". These areas include:

- Specialist retailing areas at Norwich Lanes, Elm Hill and Magdalen Street, promoting smaller scale, independent retailers and tourism functions;

- The Large district centres (LDCs) centred on Anglia Square and Riverside, which meet everyday shopping needs and a mix of other activities;

- The Sainsbury supermarket at Queens Road;

- The Cathedral Retail Park/ Barn Road – a warehouse, car based retail area.

4.92 Despite retaining a strong centre, rather than the JCS target of a 30,000 m² increase in comparison[29] floorspace to 2016, there has been a decrease of 3,500 m² (around 2%) since 2011. This is largely due to diversification of uses and an expansion of the leisure economy which has led to major growth in the number of cafés and restaurants at the expense of shops, especially in the secondary areas of the city centre.

4.93 At the same time there has been a significant rise in small scale retailing units selling everyday goods around the centre and significant growth of independent retailers, resulting in low vacancy levels in specialist retail areas. Large scale retail investors in the city centre have largely concentrated on the intensification of use of existing retail units rather than new build.

4.94 Sites to meet the planned growth of retailing were allocated in the Norwich Site Allocations Plan, while JCS and development management policies also promote intensification of uses in the city centre and expansion where necessary[30].

4.95 Recent GNLP evidence shows there is a degree of over-supply of floorspace in the short term but that around 11,000 square metres of additional comparison retail floor space will be required in the Norwich urban area by 2027. Forecasting floorspace need beyond 2027 is too unreliable to determine the need for allocations for the whole plan period.

4.96 National policy supports markets. Norwich market has been fairly successful in supporting different types of businesses and temporary markets are held elsewhere at times.

Question

- What should the plan do to promote retailing in the city centre?

Leisure and the Late Night Activity Zone

4.97 In line with national trends, there has been significant growth in café / restaurant and bars/night clubs sector in the city centre since 2008. The current policy approach distinguishes between the early evening and the late night economy. It promotes extending early evening uses across the city centre, identifying a leisure area. As a means of managing potential conflict between late night activities and residential and businesses uses, a more restrictive approach to late night activities is taken, focussing them at Riverside, Prince of Wales Road and Tombland. While management measures have been introduced through licensing, the separation of residential and late night uses has become less enforceable due to changes in national policy, and the market for night clubs appears to be declining.

Question

- Should the focus for late night activities remain at Riverside, Prince of Wales Road and Tombland or should a more flexible approach be taken?

City Centre Housing

4.98 The amount of housing in the city centre has risen significantly in recent years[31]. Delivery will be further boosted in the near future with a number of large scale allocated sites under construction or likely to commence soon.

4.99 Windfall is likely to provide a further contribution, possibly including dwellings provided through office conversions granted prior approval as permitted development. The level of this contribution will be partially dependent on the plan's approach to the loss of offices.

4.100 Housing is often provided as part of mixed use development and family housing has been specifically promoted on some sites to achieve a social mix. A number of sites allocated for mixed use development including housing have now been developed, or are being proposed for, new student accommodation.

4.101 The GNLP will need to balance providing new homes in highly sustainable brownfield city centre locations with ensuring sufficient land is available for other city centre functions.

4.102 Housing commitment in the city centre on sites of 5 or more units, along with sites submitted through the Call for Sites (which are in some cases for an intensification of uses), are set out on in the Site Proposals document.

Question

- What should the plan do to promote housing development in the city centre?

Air quality

4.103 Norwich city centre has a legally required Air Quality Management Plan. Recent road changes have been implemented to reduce through traffic and air pollution, with further measures planned such as improvements to public transport, walking and cycling facilities. The current approach in the JCS focusses growth in appropriate locations to reduce the need to travel and enable public transport use and development management policies require school and workplace travel plans, promoting alternative fuel use and supporting car sharing and car club schemes. This issue is covered further in section 6.

Cultural, Visitor and Education facilities

4.104 Cultural and visitor facilities, along with education, are planned as focuses for city centre development.

4.105 The NPPF identifies concert halls and conference facilities as main town centre uses. A JCS evidence study identified potential to provide a new medium scale conference and concert facility in the city centre, either by conversion or new build. Whilst there remains an aspiration in some parts of the community for such a facility, no market interest has been shown in developing a site.

4.106 A number of new hotels have opened in recent years and Norwich city centre is an important tourism destination.

4.107 New education facilities have been provided in the city centre for NUA, City College and free schools in recent years, largely through building conversions.

Question

- How can the plan best support cultural, visitor and educational uses in the city centre?

Remainder of the Norwich Urban Area and the Fringe Parishes

4.108 Current policy for Greater Norwich[32] covers a broad range of issues for the suburbs and built up parts of the fringe parishes, recognising that this area is home to a significant number of people, businesses and environmental assets. The area also provides vital links between the city centre and the surrounding area and opportunities for redevelopment, regeneration and enhancement.

4.109 Specific policies in the JCS and other plans cover areas identified for large scale growth such as the North East Growth Triangle.

4.110 Significant development and enhancements have taken place in the area in recent years. These include employment expansion (particularly at the NRP and Broadland Business Park), new community facilities (including those at Cringleford, Queens Hills and Costessey), green infrastructure improvements (such as at Mousehold Heath and the Yare Valley) and cycle and bus facilities. In addition, a number of new educational establishments have opened, including the University Technical College Norfolk at Harford Bridge and the International Aviation Academy adjacent to the airport. New schools have been opened and others have been improved.

4.111 Further projects are in the pipeline, particularly for the green infrastructure, cycling and bus networks.

Option

|

Option UA1 Policy for the remainder of the urban area and the fringe parishes The favoured option is to continue the current approach of supporting:

|

Question

- Do you support Option UA1 for the remainder of the urban area and the fringe parishes?

The Rural Areas

4.112 Whilst Norwich and its suburbs are clearly a very significant part of Greater Norwich, most of Broadland and South Norfolk is very rural in character. Market towns play a vital role in the rural economy, with most having a wide hinterland encompassing larger villages, smaller hamlets and open countryside. The services they provide (schools, shops, public transport, employment opportunities, healthcare, etc.) serve not only their own residents, but those for many miles around. These settlements are therefore "engines" of rural growth and prosperity and it is important that they are enabled to grow and thrive.

4.113 Smaller settlements, such as Key Service Centres (KSCs) and Service Villages, play a similar role to market towns, albeit at a smaller scale. Most current KSCs have a high school, and most Service Villages have a primary school, for example. Other Villages have fewer local facilities, and so tend to look to Service Villages, KSCs and Main Towns for some services.

4.114 In some rural parts of Greater Norwich, nearby villages can in effect "share" some services – the primary school may be in one village, a GP surgery in a second village and a food shop in a third. In this way, some "groups" of villages may, together, provide a higher range of services than each does alone.

The Main Towns

4.115 The four Main Towns of Aylsham, Diss, Harleston and Wymondham play a key role in the life of the area, supporting the economy and providing jobs and services to wide catchments. The Main Towns already have significant commitments of 3,500[33] homes and with a good range of services all the Main Towns provide opportunities for further growth. The amount of additional growth in each will depend on the growth option chosen, delivery of existing commitment and locally specific infrastructure constraints and opportunities.

Aylsham

4.116 Aylsham has a vibrant town centre which supports a sizable number of retail and service businesses. The historic core of Aylsham is a conservation area with numerous listed buildings particularly around the Market Place and Red Lion Street, and north of the centre to Millgate.

4.117 The main access to Aylsham is via the A140, with the town centre by-passed to the east, west and south. Access to most of the remainder of the Greater Norwich area and beyond will be improved with the opening of the NDR.

4.118 There are a number of recreational opportunities in or near the town including a recreation ground on Sir Williams Lane, a new football facility at Woodgate Farm, the Bure Valley Way, the Marriotts Way and facilities at Blickling Hall. New development is likely to be able to support additional recreational facilities.

4.119 Blickling Hall, with its 384 hectares of historic parkland and woodlands, is one of the wooded estatelands which charcaterise much of the landscape around Aylsham. The Bure river valley forms a second landscape character area which limits expansion to the north and east, while there are fewer constraints to the west and south of the town.

4.120 Aylsham has seen a significant number of homes built since 2008. Current commitments total 350 homes, with the development of allocated sites progressing well. There is continuing strong market interest in developing housing in Aylsham. Five proposed housing sites have been submitted around the town through the Call for Sites, totalling 58 hectares in area.

4.121 The 55 hectare Dunkirk Industrial Estate lies to the north east of Aylsham and includes two long term allocations. There has been limited new development on these in recent years and speculative development is considered unviable.

4.122 There is a good range of services and facilities within the town including primary and secondary education. There are two GP surgeries and a dentists in Aylsham, all of which are still accepting patients.

4.123 In the past waste water disposal issues have been identified as having the potential to constrain further large scale growth at Aylsham as it is located close to internationally designated wildlife habitats in the Broads. Recent work with the Environment Agency and Anglian Water in connection with planning permissions and allocations in Aylsham has shown that bespoke solutions for water management are suitable for the current amount of commitment, but the capacity for growth could be limited.

Diss

4.124 Diss is at the southernmost part of the GNLP area on the border with Mid-Suffolk. It is close to the crossroads of the A140 and A143 and is on the Norwich to London railway line. Much of the older historic development of the town has been along Victoria Road, parallel to the River Waveney, with the settlement having subsequently developed northwards. The built up area around Diss also extends into the adjoining parish of Roydon, which is itself a Service Village.

4.125 Diss has an attractive conservation area at its core, with an exceptional concentration of listed buildings. As well as including the core of the town centre, the conservation area extends around a series of particularly important and distinctive open spaces at: The Mere and adjoining Diss Park; the Parish Fields; Mount Street Gardens; Rectory Meadow; and Fair Green. A separate conservation area covers an area of Victoria Road.

4.126 To the south of the town is the River Waveney which is a natural restriction on growth in that direction. To the east of Diss the landscape and tributary streams of the Waveney potentially limit expansion in this direction.

4.127 The commitment for Diss and Roydon is 319 homes. Diss has experienced steady growth over recent years. There are no known barriers to the delivery of the current commitments, which are expected to be completed by 2020, indicating that there would, in housing market terms, be scope for early delivery of additional sites. Fourteen proposed housing sites have been submitted around Diss and Roydon through the Call for Sites, totalling 51 hectares in area.

4.128 Traffic issues have long been a significant local concern. The scale of growth in the town will be partly dependent on how additional pressure on the historic town centre could be absorbed, both in terms of traffic capacity on the A1066 which runs through the town from west to east and also the ability to serve any additional development.

4.129 Relative to its size, Diss offers a wide range of employment opportunities, with two significant employment areas close to the station. The current local plan allocates a total of 15 hectares of employment land, a mixture of new allocation and already permitted or allocated sites. There are no known barriers to the delivery of the current commitments, although the town is close to the Mid-Suffolk Business Park at Eye Airfield, where land is allocated for in excess 100 hectares of employment, and which could affect the overall market in the area.

4.130 Diss has the second largest number of shops and services in Greater Norwich after Norwich. These serve a wide hinterland in the south of Norfolk and the north of Suffolk. Diss High School Academy includes a sixth form and there are no known capacity issues in terms of accommodating the current growth of Diss and the surrounding villages. The two GP practices in Diss are currently accepting new patients, as is one of the dental practices.

4.131 There is a good range of community facilities within the town including the leisure centre (with gym and swimming pool), library and community and arts venues such as the Corn Hall and the Youth and Community Centre. Recreation facilities are provided at the Sports Ground with dedicated facilities provided by the larger sports clubs at Diss Town F.C. and Diss R.F.C. at Roydon. However, if identified for large-scale development detailed investigation would be needed into what facilities could be expanded, and the impact of nearby smaller settlement that rely on Diss.

4.132 With its employment opportunities, good transport links and extensive hinterland Diss could sustain further development. However, the amount of growth at Diss may be limited by its road capacity and landscape issues.

Harleston

4.133 Harleston is in the south of the GNLP area, bordering Mid-Suffolk. It is close to, and primarily accessed by, the A143. Harleston is an historic market town and employment centre serving a relatively wide local catchment. It is a compact town set between two river valleys, with the River Waveney providing the setting to the south of the town.

4.134 The town centre, which contains a number of former coaching inns and courtyards, is a conservation area. Residential estate development outside the centre has incrementally increased the population of the town, though it remains compact. The A143 to the south and east constrains growth in those directions. Starston Beck and a sewage treatment plant to the north of the town also form growth constraints, while there are fewer constraints to the west.

4.135 The commitment in the whole parish of Redenhall with Harleston is 157 dwellings. Market interest in Harleston has been limited with three proposed housing sites submitted around the town through the Call for Sites, totalling just 2 hectares in area.

4.136 The centrally located supermarket, the strong independent retail offer and the distance from other market towns mean that Harleston is likely both to continue to support a fairly wide local catchment for day-to-day shopping needs and to draw day visitors from further afield for leisure shopping trips.

4.137 Traffic issues and parking are a significant local concern. The scale of any additional growth in the town will need to take account of how additional pressure on the historic town centre could be addressed. Surface water flooding has also been an issue in the town centre.

4.138 The leisure centre, church, community hall, school and GP practice are all within close proximity of the town centre. The GP practice and the dentist are currently accepting new patients. Capacity to extend the primary school and the high school has not been confirmed, but as the high school is on the edge of the built-up area, expansion may be possible.

4.139 The potential for additional expansion may be limited by the likely need for a new water supply to serve additional growth and the limited number of submitted sites.

Wymondham

4.140 Wymondham is the largest settlement in the GNLP area outside Norwich and one of the main towns on the Cambridge-Norwich Tech Corridor. Due to its location and wide range of services and facilities the town has experienced steady growth over recent years.

4.141 Wymondham is currently the largest South Norfolk growth location. The parish, which includes the smaller settlements of Suton, Silfield and Spooner Row, has an outstanding commitment of 2,674 dwellings. All of the main committed sites are have commenced development and are due to be completed by 2026. Despite some significant infrastructure requirements, such as improvements to access under the railway bridge, there are no known barriers to the timely completion of this development. Twenty-five proposed housing sites have been submitted around the town through the Call for Sites, totalling 593 hectares in area. In addition, a site for a new settlement between Wymondham and Hethel of 364 hectares been submitted for consideration (see paragragh 4.63).

4.142 The location of the town and the high quality of services (especially schools) means housing market is strong, as exemplified by both allocated and non-allocated sites being developed currently and in recent years. Constraints to further large-scale housing include:

- secondary school capacity;

- the setting of the Grade I listed (and nationally significant) Wymondham Abbey;

- the protection of the setting of the town, particularly the character of the river valleys and maintaining the separate identities of the settlements on the A11 corridor; and capacity to expand the town centre.

4.143 A new primary school is proposed as part of the South Wymondham development, replacing the existing Browick Road School [please see schedule of corrections]. However the continued growth of the town is likely to require further consideration of primary school provision.

4.144 Wymondham High School Academy is on a 'land-locked' site; the school has a development plan which maximises the potential of the existing site to accommodate the majority of planned development to 2026, however beyond this there are critical issues in relation to secondary school capacity which need to be addressed before any further growth is considered. Additional secondary school provision exists at Wymondham College, Morley, south of the town. Whilst there is no immediate capacity at the school, it is on a site where additional space could be provided. However, depending on the sites chosen for growth at Wymondham, the College could be a considerable distance from new housing, and distant from other services, facilities and employment. At present the admissions arrangements for the College are different to other secondary schools which could also complicate the situation.

4.145 The historic core of Wymondham has an extensive conservation area with a large concentration of listed buildings, centred on the Market Cross. Particularly important to the townscape are the setting and views of the grade 1 listed abbey. The development of Wymondham, predominately to the north and east of the historic centre, means that from the Tiffey Valley, Wymondham still has the 'sense of a small historic town set in a rural landscape[34]'. To the north and east of the town centre there are large areas of estate-scale development from the mid-20th century onwards, which is still continuing today, as well as large commercial and employment buildings, particularly around Gateway 11.

4.146 Wymondham is close to the expanding employment area at Hethel. Improved connectivity between Wymondham and Hethel is a key area for improvement. A 20 hectare allocation has been made at Hethel specifically for 'uses associated with, or ancillary to, advanced engineering and technology based business[35]'. The allocation relates to the existing businesses at Group Lotus and Hethel Engineering Centre.

4.147 The historic pattern of growth means that there has been little pressure on the countryside between Wymondham and Spooner Row; conversely there has been significant pressure on the remaining countryside between Wymondham and Hethersett, leading to the designation of this area as a Strategic Gap. The gap also includes the historic Kett's Oak.

Long Stratton

4.148 It is anticipated that Long Stratton, which is currently classified as a Key Service Centre rather than a Main Town, will be re-classified as a Main Town once planned growth of around 2,000 homes takes place as it is anticipated that there will be a consequent growth in services. However, the potential for additional growth beyond that proposed through the AAP could be limited by waste water treatment issues. Two sites have been proposed in Long Stratton through the Call for Sites totalling 11 hectares.

Question

- Do you know of any specific issues and supporting evidence that will influence further growth in the Main Towns?

Settlement Hierarchy

4.149 The Greater Norwich settlement hierarchy will group places together according to the availability of services and facilities, access to employment and opportunities for sustainable and active travel. Places that have similar characteristics are grouped in the same level of the hierarchy. In this way, the hierarchy helps to ensure that growth is distributed according the range of supporting services and infrastructure that are available in a particular location.

4.150 This approach is consistent with the NPPF which favours prioritising growth in settlements where it is supported by existing services, facilities and infrastructure, has the strongest links between homes and jobs and where opportunities for sustainable transport are maximised.

4.151 In order to maintain the vitality and viability of settlements and enhance choice and competition in the market of land for housing across Greater Norwich, it is however important that growth is distributed across the whole of the hierarchy, not just in those places at the top of it. Options for the distribution of growth to different levels of the Settlement Hierarchy are set out in paragraphs 4.65 to 4.66 of this consultation document.

Options for Defining the Settlement Hierarchy

4.152 A settlement hierarchy is identified in current JCS policy.

4.153 The existing hierarchy has six tiers:

- Norwich Urban Area

- Main Towns

- Key Service Centres

- Service Villages

- Other Villages

- Smaller Rural Communities and the Countryside

4.154 The top three tiers have well defined criteria which it is not proposed to change. However, in order to enable more growth to support the social sustainability of smaller villages and the countryside, we are considering combining tiers 4 to 6 of the hierarchy so that they become a single tier, "Village Groups".

4.155 Village Groups are based on the premise that neighbouring villages share services. The implication of Village Groups is that villages or hamlets with few or no services would be considered suitable for growth if services could readily be accessed in neighbouring settlements. We are consulting both on whether this is a suitable approach and how it could work in practice.

4.156 As part of the possible changes to the settlement hierarchy, we are also considering changing the title of tier 3 from Key Services Centres to Service Centres.

4.157 Under either option, additional growth could come from windfall development, the scale of which will depend on the approach taken (see options AH7 and 8).

4.158 The two reasonable alternatives, as set out in detail in figures 5 and 6 below, are:

Options

|

SH1 |

Have a 6 tiered hierarchy This would broadly be a continuation of the current approach, with some changes in the detail for tiers 4 to 6. The amount of growth that would take place in the different tiers of the hierarchy would be dependent on the scale and range of services. |

|

SH2 |

Have a 4 tiered hierarchy including Village Groups as tier 4. This would be a new approach. While tiers 1 to 3 would be the same as Option SH1, all remaining parishes below tier 3 would be amalgamated into Village Groups. |

Figure 5 Proposed settlement hierarchy – Option SH1

|

Hierarchy tier |

Locations and settlements |

Criteria and growth considerations |

|

1. Norwich Urban Area |

Norwich, the built-up parts of the fringe parishes of Colney, Costessey, Cringleford, Trowse, Thorpe St Andrew, Sprowston, Old Catton, Hellesdon, Drayton and Taverham and the remainder of the Growth Triangle. |